It's no secret that the New York metropolitan area is among the most expensive in the country, but what does that really mean in terms of what you'll spend to rent here and what you can really afford?

In every survey of the nation's highest rental rates, you'll see New York metro area communities ranking near the top.To budget accordingly, renters need to take a hard look at what landlords expect in terms of income and credit. But even if you can qualify for your dream rental home, is it really in your budget? Let's take a closer look at what you COULD spend versus what you SHOULD spend when it comes to renting and living in New York.

Most New York City landlords will look at an array of financial data when reviewing your rental application. They'll want to see your credit report and score. They'll likely request your past rental history, a bank statement and employment verification. They'll look at paystubs or tax returns to substantiate income.

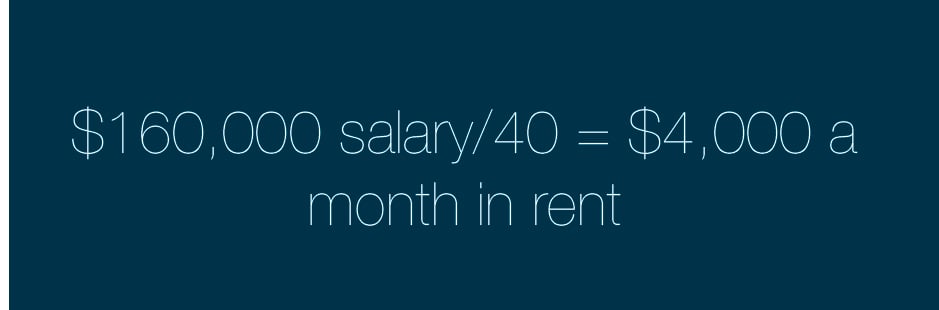

For income, New York area landlords will require that you earn anywhere from 40 to 80 times the monthly rent in gross annual salary, with the standard being in the 40 to 50X range. To quickly determine the highest rent you'll qualify for, divide your annual salary by 40. For example, to afford a $4,000 a month one-bedroom in Tribeca, you'll need to earn at least $160,000 a year in gross income. For a $2,500 studio in Williamsburg, you'll need to earn $100,000 minimum.

At Dixon Leasing, we require prospective tenants earn three times the monthly rate on a monthly basis, which works out to 36X the rent on annual basis, a bit below the area standard. To learn more about our application requirements, review our guidelines or download our first-time renter's guide.

Now that you know what you could spend on rent, let's talk about what you should spend in terms of overall budget and lifestyle. If you barely meet the 40X minimum salary standard, you'll be spending 30 percent of your annual income on rent. How does that fit in with the rest of your expenses?

Keep in mind that in addition to high rents, New York City cost of living, across the board, is about 70 to 200 percent higher than the national average. That means that everything from your toothbrush to your electric bill will cost more here.

Let's take our example Williamsburg renter who qualifies for a $2,500 apartment on a $100,000 salary. We'll assume she's a 20-something professional with a full-time job in Manhattan and an active social life.

Here's what she might pay in expenses each month:

First, she'll have to pay the tax man, a lot. In fact, once her employer combines federal, state and city taxes with social security and Medicare contributions, that's nearly $30,000 a year, right off the top. For health insurance, assuming she has an employer plan, she can expect to pay around $1,500 a year on the low end. And let's go ahead and add in $240 for renter's insurance, which is required by some landlords. Getting to work will cost about $1,375 on the subway, and that doesn't include any non-work MetroCard swipes. She'll have many welcome-to-New-York moments in the grocery store, where even a light eater can plunk down $100 a week on food and sundries, easily. Utilities, namely gas, electric, cable and WiFi, plus online subscriptions for Hulu, Neflix, et al, will total about $2,400 a year. And don't forget about her 401(K) or other retirement savings. Even a modest contribution per paycheck will total around $6,000. All this equates to nearly $75,715 a year just for the very basics.

But what about a few lunches out of the office, and a couple of happy hours and nights out with friends (plus the Uber rides home) each month? That's easily $5,000 a year. Hair and nail appointments? $2,000 a year in New York City would be a modest tab. A week's vacation? Better budget $1,000 to $2,000. Hope to be a dog owner? With a full-time job, you'll spend $2,400 or more a year for a dog walker, groomer, food and vet bills. What about savings, student loan repayments, gifts, laundry and dry cleaning, trips to see family, unexpected emergencies? Poof! Just like that, her $100,000 salary is spent.

Our point is not to dash your New York dreams, but to illustrate that just because you could spend 30 percent of your salary on rent, doesn't mean you should. Take into consideration all of your spending and savings goals before you sign on your lease's dotted line.

201 366 8692

201 366 8692